Fixed assets

You can find all fixed asset related operations in SmartAccounts under the Fixed assets menu item.

‘Fixed assets’ – ‘Fixed assets’ – a list of all fixed assets with the option to add, delete or edit an asset.

‘Fixed assets’ – ‘Depreciations’ – a list of all fixed asset depreciations with the option to add, delete or edit a depreciation.

‘Fixed assets’ – ‘Fixed asset report’ – a report detailing the purchase price, depreciation and residual value of selected fixed assets for a selected period.

‘Fixed assets’ – ‘Fixed asset settings’ – a place to see and change the default values, accounts and groups of fixed assets.

Fixed assets toolbar

The toolbar on the ‘Fixed assets’ – ‘Fixed assets’ page allows you to perform the following actions:

‘Add new’ – add a new fixed asset manually.

‘Purchase’ – start the fixed asset registering process via purchase invoice. Directs you to a new purchase invoice.

‘More’ – open fixed asset settings or choose the fields shown in the fixed assets list.

‘Help’ – open this user guide.

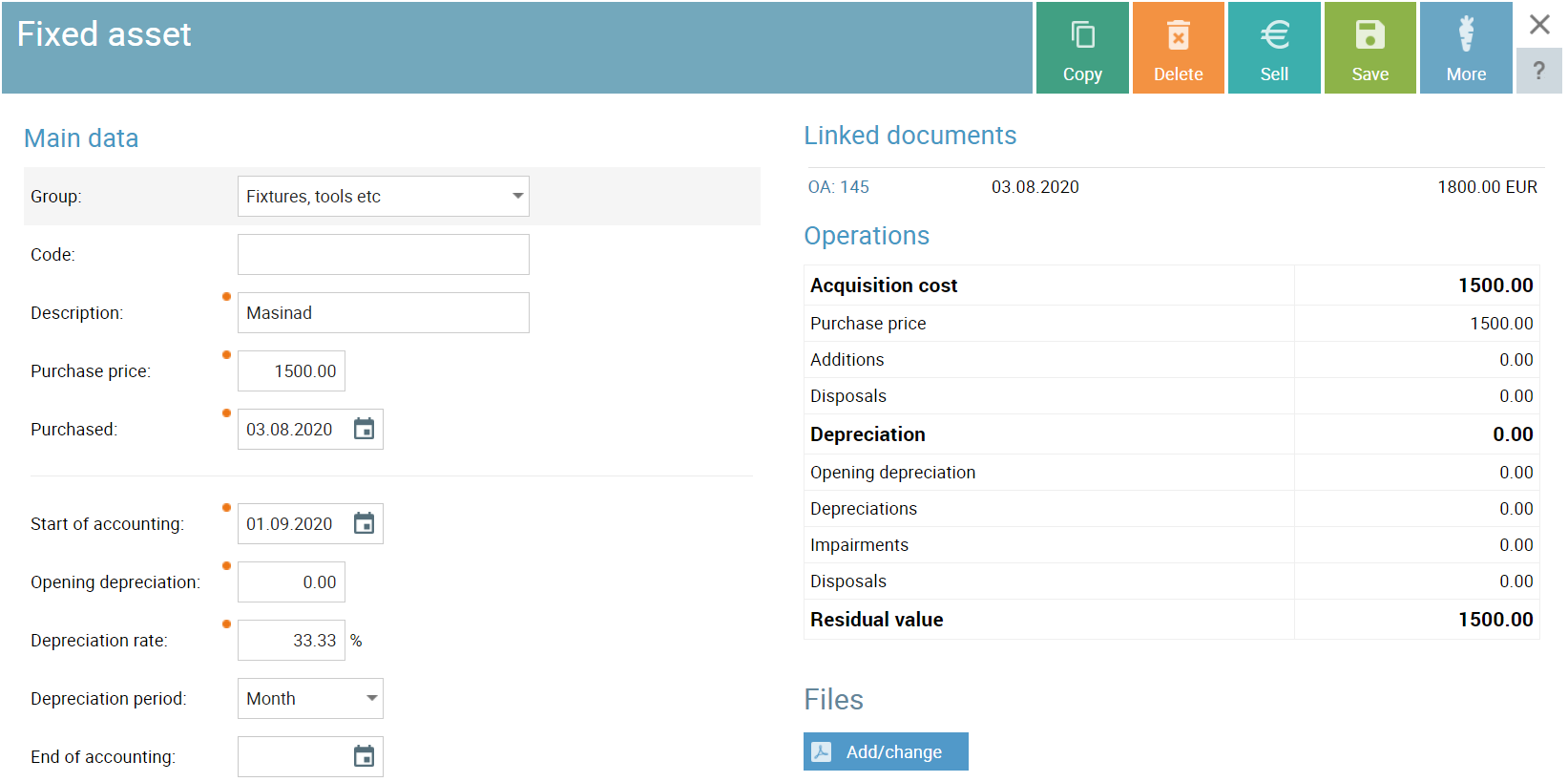

Fixed asset chart

Group. Fixed asset groups group together fixed assets with the same:

- fixed asset account

- depreciation account

- expense account

- depreciation rate

If you choose a group for the new fixed asset, the accounts and depreciation rate of the asset are filled out automatically with the default values of the group.

Code. An optional code for the asset.

Description. The name or description of the asset.

Purchase price. The initial purchase price of the asset.

Purchased. The date the asset was purchased on.

Start of accounting. The date starting from which the asset is included in depreciation calculations.

Opening depreciation. Previously calculated depreciation on the start of accounting date. The default value for new assets is 0. This value is included in depreciation and used to calculate the asset’s residual value.

Depreciation rate. The percent of acquisition cost that depreciates every year. Used in period depreciation calculations. If the depreciation rate changes, a history of different rates is shown.

Depreciation period. The period of depreciation can be 1 month, 1 quarter or 1 year. Depreciation entries for the asset are created on the following date:

- month – the last day of every month;

- quarter – the last day of the last month of every quarter;

- year – the last day of the year.

End of accounting. The date up to which the asset is included in depreciation calculations. For example, if ‘End of accounting’ is set to 28.02.2019 the asset’s last depreciation period will be February 2019 and the asset will be excluded from any later depreciations.

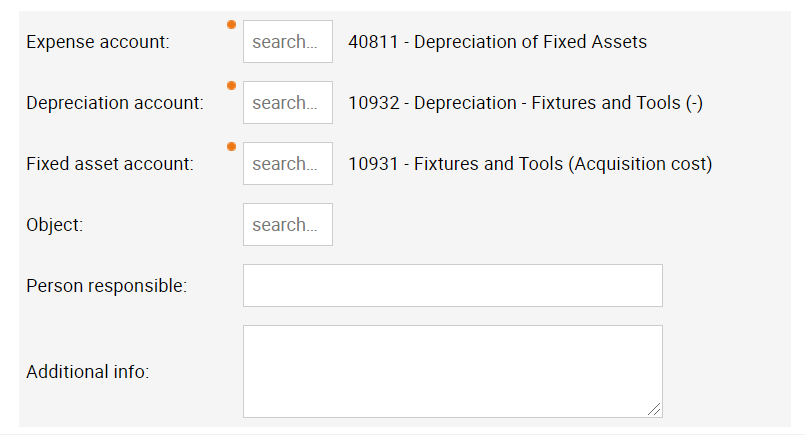

Expense account. Fixed asset depreciation expense general ledger account.

Depreciation account. Fixed asset depreciation general ledger account.

Fixed asset account. Fixed asset general ledger account.

Object. Allows you to select an object that will be added to the depreciation and its general ledger entry row.

Person responsible. The name of the person responsible for the fixed asset.

Additional info. Any additional information about the asset.

Files. Files connected to the asset.

Operations

An overview of the asset’s status and a history of its different operations:

- additions

- disposals

- impairments

- acquisition cost

- depreciation

- depreciations

- residual value

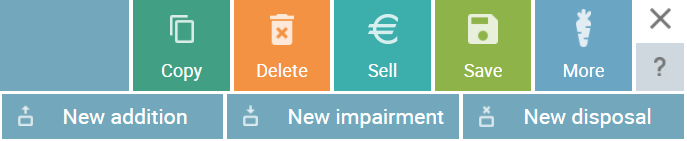

Fixed asset chart toolbar

The toolbar on the fixed asset chart allows you to perform the following actions:

The toolbar on the fixed asset chart allows you to perform the following actions:

‘Copy’ – copy the fixed asset chart.

‘Delete’ – delete the fixed asset (if it doesn’t have any connected operations).

‘Sell’ – start the fixed asset disposal process via sales invoice. Directs you to a new sales invoice.

‘Save’ – save the fixed asset.

‘More’ – add new additions, impairments and disposals.

All help documents

- Fixed asset settings

- Fixed asset purchase

- Fixed asset sale

- Fixed asset impairment

- Fixed asset additions

- Fixed asset disposal