The June updates introduce several useful tools that significantly streamline the daily tasks of accountants. For example, it is now possible to conveniently send TSDs (payroll tax forms) to the Tax and Customs Board in addition to VAT returns.

Additionally, regular users can now terminate their rights in companies with which they are no longer associated. Let’s delve into the details.

Key topics this time include:

-

- e-MTA interface – Submitting TSDs

- Termination of regular user rights

- Simplified entry of tax-free income in certain situations

- Document filtering by creator

- Additional columns in the list of recurring invoices

- Support for international reference numbers

Submitting TSDs (payroll tax forms)

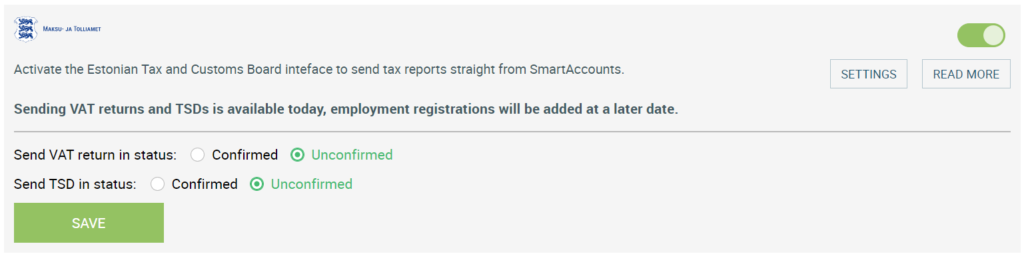

Great news – besides VAT returns, it is now possible to directly send TSDs from SmartAccounts to the Tax and Customs Board! If the interface with the Tax and Customs Board is already activated, there is no need to add additional rights for sending TSDs. If the e-MTA interface has not been configured yet, you can read about it here.

On the ‘Settings – Connected services’ page, you can review whether the TSD is sent to the e-MTA in a “Confirmed” or “Unconfirmed” state. If additional attachments need to be submitted along with the main TSD form and annexes 1 and 2, it is important to select “Unconfirmed” to send the declaration.

You can also choose the state of the TSD before every send.

Ending the user rights now easier

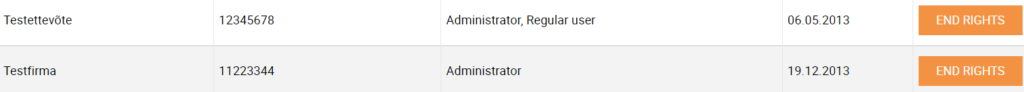

Until now, only the administrator could terminate user rights associated with a company. However, we have now added this option for users with other permissions as well. This is usually necessary when the company is no longer active, and terminating rights through the administrator is not possible for some reason.

Users who are not the last administrator of the company can terminate their user rights in the desired company from the ‘Settings – My Companies’ page.

Simplifying the entry of tax-free income in certain situations

Often, there are situations where multiple payments in the same month exceed the tax-free income threshold for an employee, making it tedious to make corrections. We have made a small enhancement to make the correction of tax-free income associated with the same TSD code slightly more convenient.

For example, in the case of vacation pay and additional salary payments, it is now possible to enter a negative tax-free amount, which automatically adjusts the calculations for these types of payments.

If the tax-free amount is exceeded, a notification will be displayed to the user, along with the excess amount. The user can enter this excess as a negative amount on the salary row, and no further adjustments are necessary – the tax calculation will be automatically adjusted by this payout.

Note: As mentioned before, this solution only works for payments with the same TSD code. It cannot be used for payments with different codes because the Tax and Customs Board does not accept declarations with a negative tax-free amount.

Filtering documents by creator

As a small but significant enhancement, we have added a user filter to all major screens. With this filter, it is possible to search for entries, payments, invoices, and other documents entered by a specific user. This makes finding documents entered by a particular user much easier.

Additional columns in the list of recurring invoices

We have added some valuable additional columns to the list of recurring invoices:

- Amount without VAT

- Netting

- Grouping

You can view/modify the displayed fields in the list by going to ‘Sales/purchases – Recurring invoices – More – Choose fields’.

Support for international reference numbers

While previously only Estonian-standard reference numbers were allowed, with the update, we have expanded this option and now accept international reference numbers (i.e., reference numbers starting with the prefix “RF”).

***

We wish you a fantastic start to the summer and hope that you have found many new and exciting features among these updates!

If you have any questions, please write to us at info@smartaccounts.eu or call 660 3303.