Activation of the Tax and Customs Board interface

Through the Tax and Customs Board interface, it is possible to send VAT returns, TSD and contracts to Employment register (TÖR) from SmartAccounts to the e-MTA environment.

Please note that currently, contract changes and terminations must be manually processed in the Employment Register.

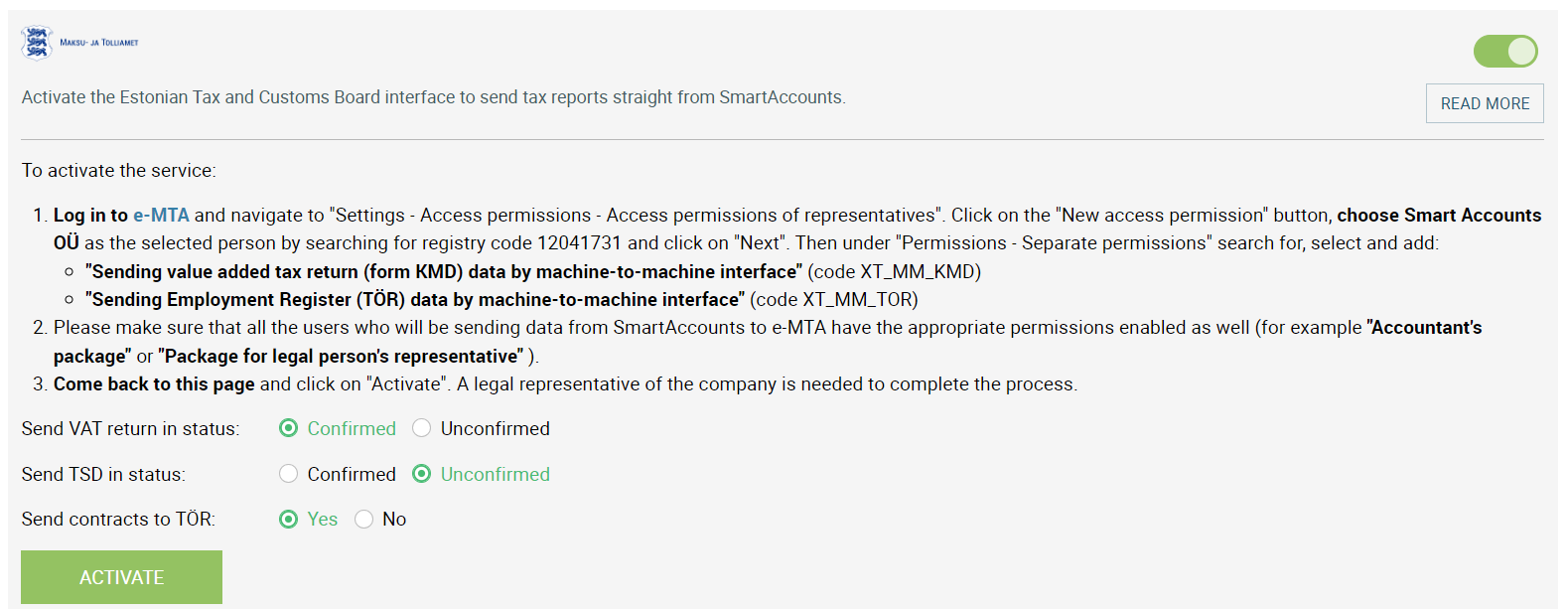

Activating the service

- To activate the service, log in to e-MTA and navigate to “Settings – Access permissions – Access permissions of representatives”.

- Click on the “New access permission” button, choose Smart Accounts OÜ as the selected person by searching for registry code 12041731 and click on “Next”.

- Then under “Permissions – Separate permissions” search for, select and add:

- “Sending value added tax return (form KMD) data by machine-to-machine interface” (code XT_MM_KMD).

- Please make sure that all the users who will be sending data from SmartAccounts to e-MTA have the appropriate permissions enabled as well (for example “Accountant’s package” or “Package for legal person’s representative” ).

- Come back to SmartAccounts and set the status of your declarations. If ‘Confirmed’ is selected, the declaration is sent to e-MTA in a confirmed state. If ‘Unconfirmed’ is selected, the declaration is sent to e-MTA in an unconfirmed state and you must additionally log in to e-MTA and confirm it there.

- Then click on “Activate” and a legal representative of the company can complete the process.

NB! Only authenticated users may send data to e-MTA. Unauthenticated users will be prompted to prove their identity via ID-card, Mobile-ID or Smart ID before the first send request.

Emplyment Register

The TÖR interface is automatically active for all companies already using the Tax and Customs Board interface. To deactivate the Employment Register interface, go to Settings – Connected Services – Tax and Customs Board.

Tax and Customs Board interface