Fixed asset settings

On the fixed asset settings page you can manage your company’s fixed asset settings.

General settings

Depreciation period: Set your value to month, quarter or year.

Depreciate automatically: Enable this option and you don’t have to depreciate your fixed assets manually. For example if you’ve chosen “Month” as the depreciation period, the depreciation entries are created for the past month automatically on the first day of every month.

Depreciation is not calculated retroactively so if you add fixed assets in the past, you have to depreciate those manually up to the present period. After that, the automatic depreciation will take over. The process will ignore any assets that already have manual depreciations in the period.

Fixed asset impairment and disposal account: This account is used for recording loss from impairment or disposals of fixed assets.

Fixed asset sales account: This account is used for recording profit or loss from sales of fixed assets. Automatic fixed asset disposal is proposed if it’s used on a row of a new sales invoice.

Fixed asset groups

Like the name says, fixed asset groups group together fixed assets with the same:

- fixed asset account

- depreciation account

- expense account

- depreciation rate

The names, depreciation rates and the accounts of these groups can be changed and new groups can be added or existing (unused) ones deleted.

How are fixed asset groups used?

Fixed asset groups are used to register new fixed assets when entering a purchase invoice. A new fixed asset registration is proposed if any group’s fixed asset account is used on a purchase invoice row. The purchase invoice is then registered using the default values of the group.

Fixed asset group values are also useful when registering a fixed asset manually in ‘Fixed asset’ – ‘Fixed asset’ – ‘Add new’ by choosing the right group for the asset.

An example:

Let’s suppose a company buys a new fixed asset and uses the 10921 – Machinery and Equipment (acquisition cost) account on a new purchase invoice row.

Since this account is the fixed asset account of the company’s fixed asset group ’Machinery and equipment’, the fixed asset can be registered automatically.

Once the purchase invoice “Save” button is pressed, a pop-up dialogue for this action is displayed to the user.

Find out more by reading Registering a fixed asset with a purchase invoice

Default groups

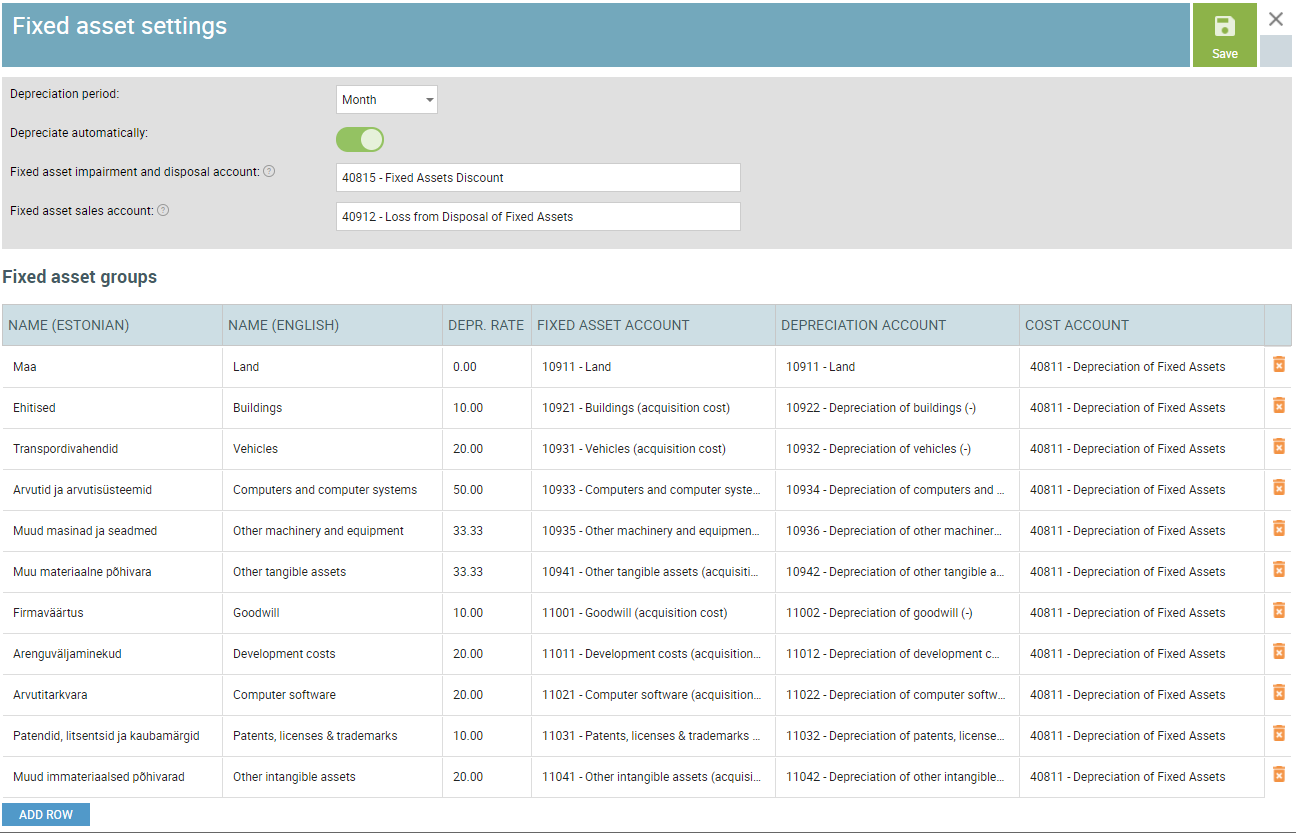

New companies will be created with 11 default fixed asset groups.

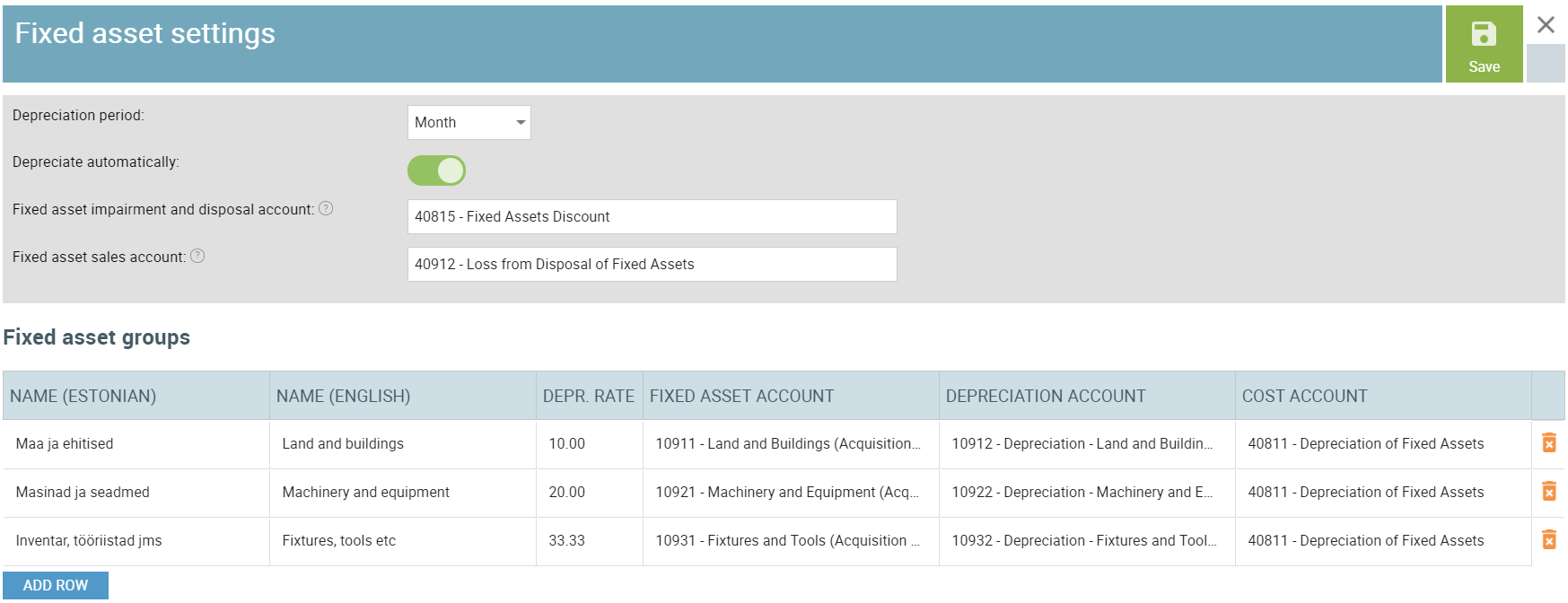

5 or 3 default fixed asset groups will be added to most existing companies depending on their income statement scheme and existing chart of accounts.

If the fixed assets section of a company’s chart of accounts has been changed, only one generic fixed asset group will be created.

NB!

If the company has only one fixed asset group we recommend you create additional ones for every major type of fixed asset. These are necessary for automatic and easier manual registering of any future fixed assets the company acquires.

Possible group settings: