Bank Payments

Here you can mark the invoices as partially or fully paid.

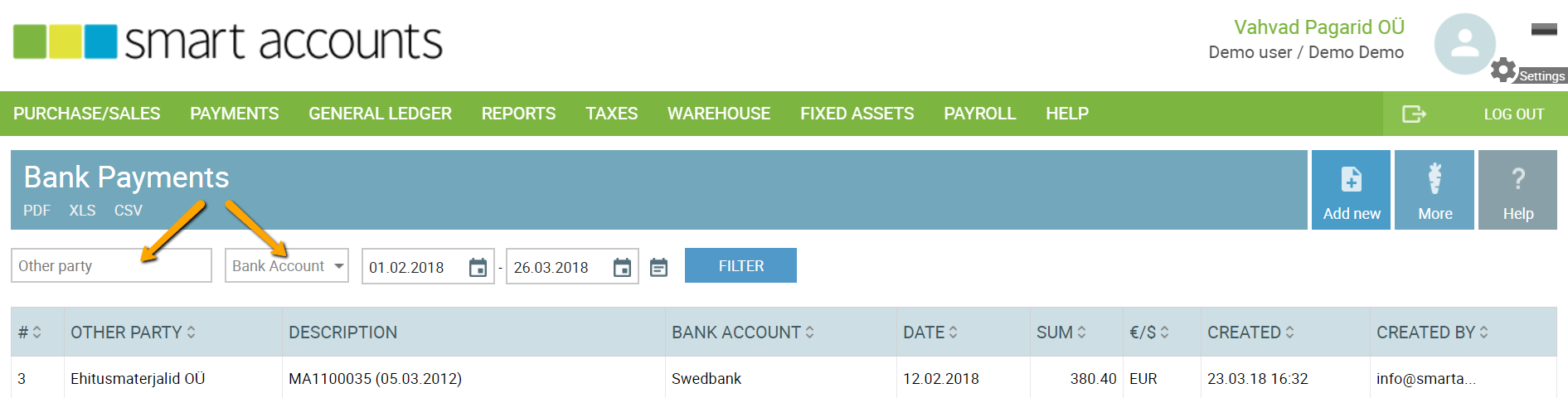

The list on bank payments

Under ‘Payments‘ – ‘Bank Payments‘ you can see the list of all bank payments. By default, you can see payments from the beginning of the previous month until today. For the older payments to be displayed in the list, just change the date range in the date filter.

To find a specific payment, try to search by the name of other party or by choosing one bank account. Please keep in mind that the date range can interfere with your search so if you’re looking for a specific payment allow the date range to be large enough for the payment to be in that range.

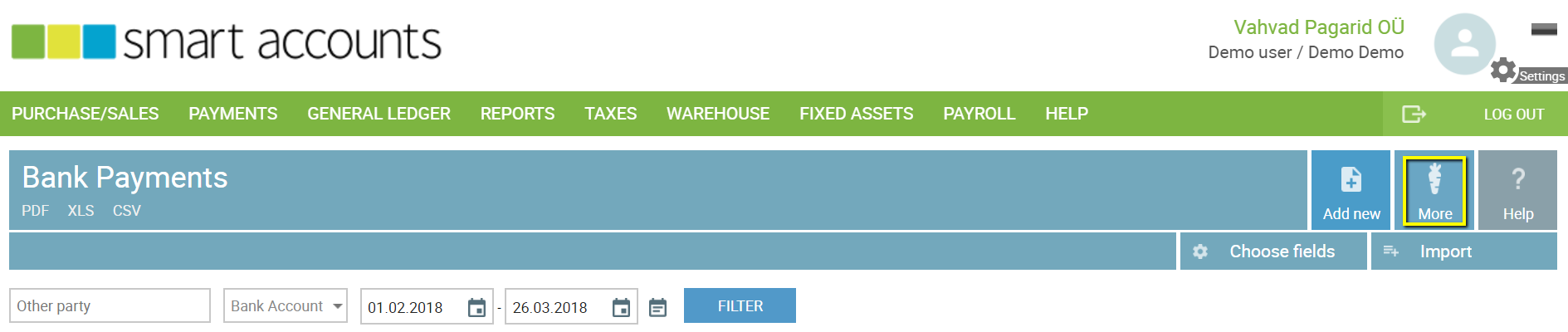

Under the menu item ‘More‘, you can access hidden options:

- Choose fields – choose which columns you want to see on bank payments screen

- Import – import bank account statement (ISO XML file)

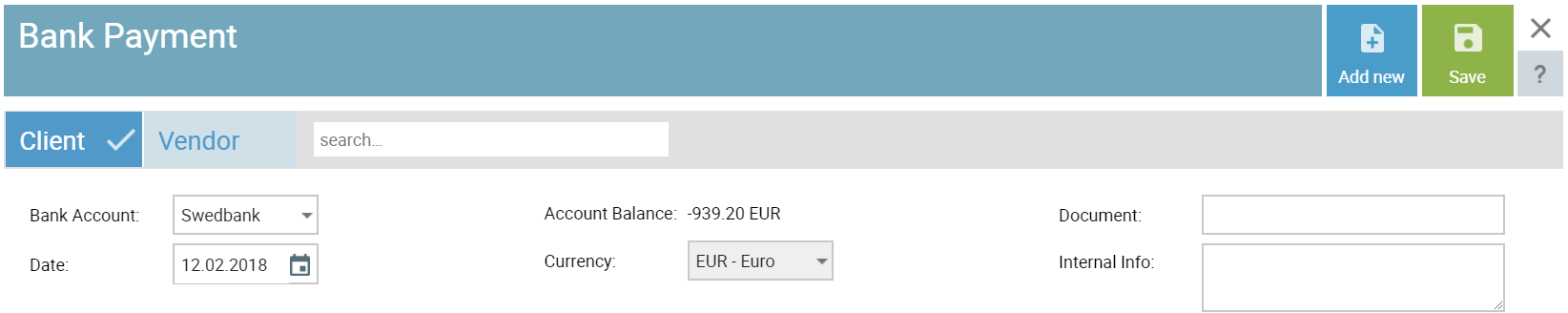

Add a new payment

You can add bank payments by navigating to ‘Payments‘ – ‘Bank Payments‘ – ‘Add new‘.

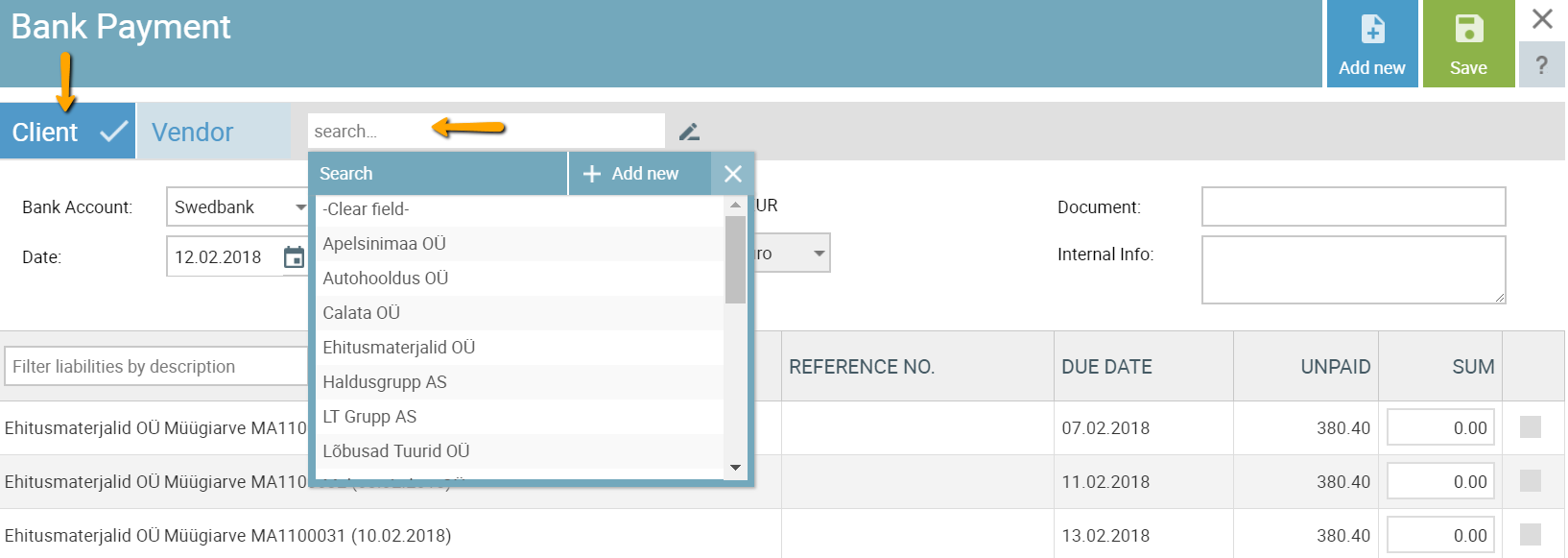

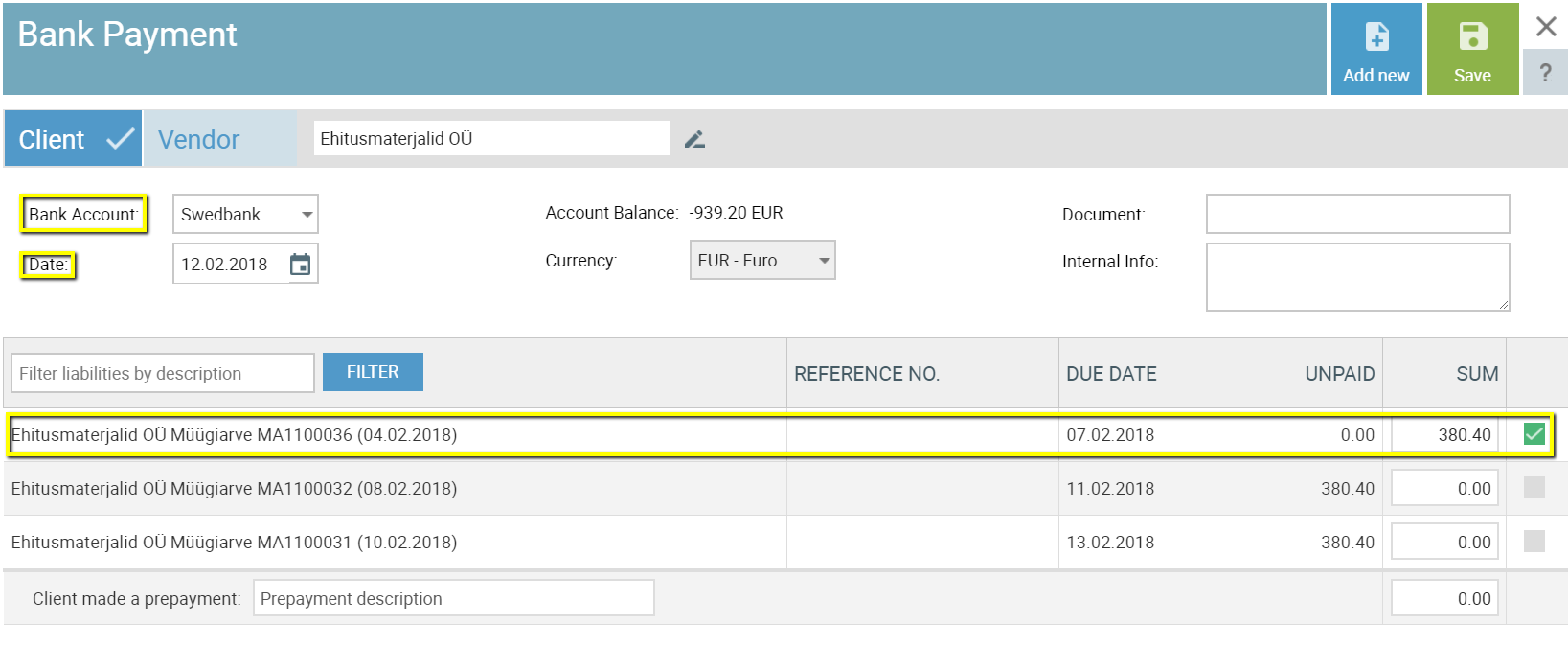

Please select the Client tab to receive payment for sales invoice (basically money ‘in’) or Vendor tab to make a payment for a purchase invoice or a receipt you’ve entered under purchase invoices.

Next please select a client or a vendor and the related invoice.

Mark the invoice row (see the green tick on the far right of the screen below), choose the right bank account, set transaction date and save the payment.

Prepayments and Overpayments

Prepayments

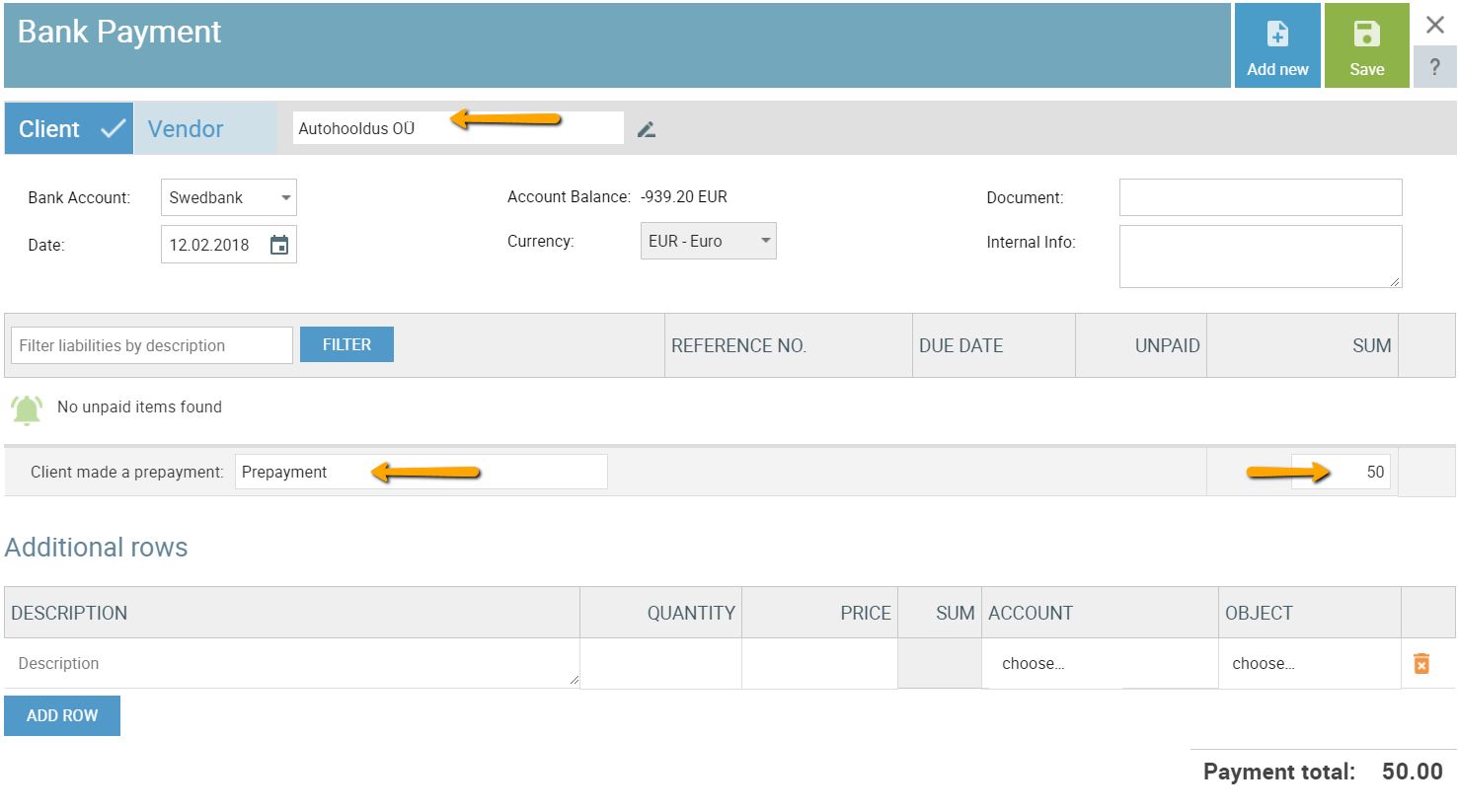

If you’ve received a prepayment from your client or you’ve made one to your vendor please add a new bank payment (navigate to ‘Payments’ – ‘Bank Payments’ – ‘Add new’).

Select a client or a vendor and fill in the prepayment description box (“Prepayment for order OT112” for example) and the sum of prepayment.

Save the payment.

Overpayment

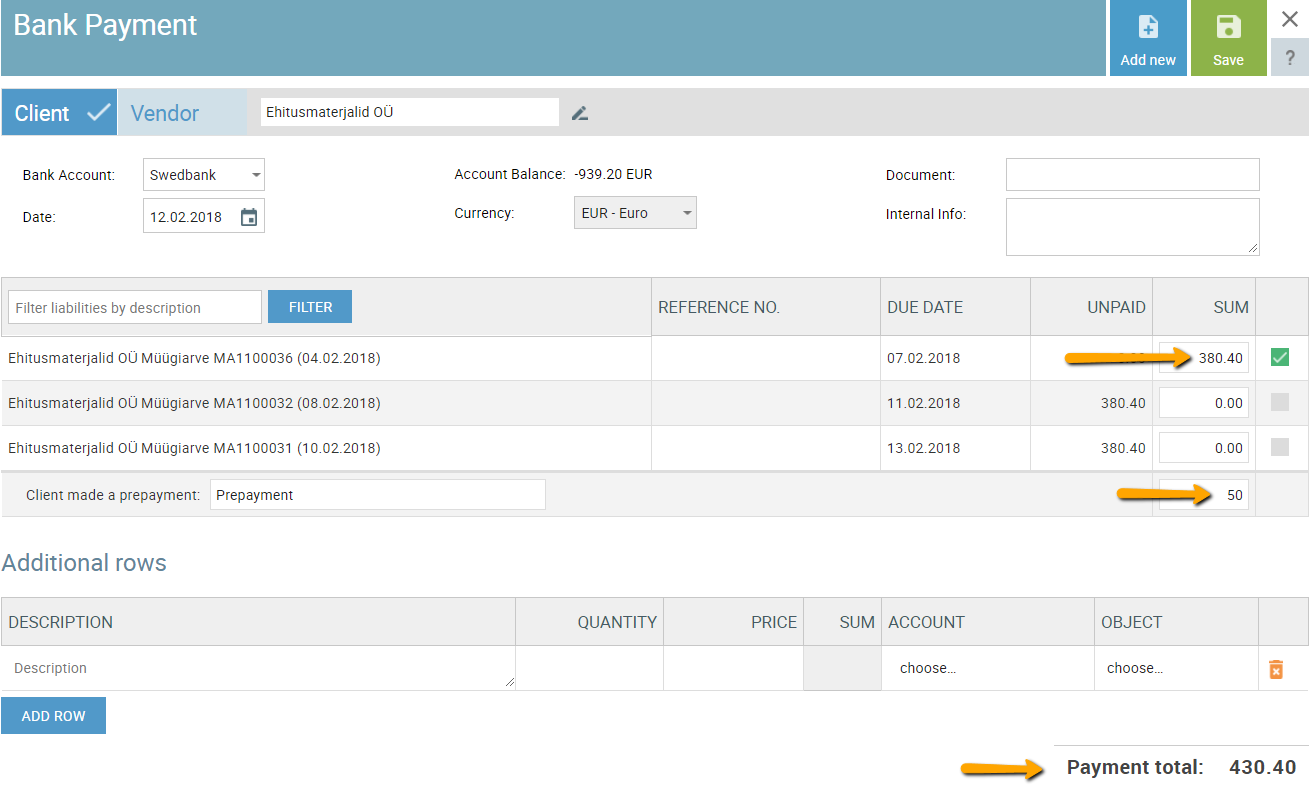

The overpayment is a transaction where your customer pays you accidentally a larger amount you’ve invoiced for or you accidentally overpay your vendor.

To record overpayment on sales invoice or purchase invoice, please add a new bank payment (‘Payments’ – ‘Bank Payments’ – ‘Add new’) and select a client or a vendor. Again, tick the invoice your client has paid (this will allocate only a part of the total payment amount) and add the exceeding amount as a prepayment.

The overpaid amount will be shown as a prepayment in prepayments report (‘Reports’ – ‘Other Reports’ – ‘Client Prepayments’/’Vendor Prepayments’) and this can be used to settle a new invoice in the future for example.

Allocate outstanding prepayment to the sales or purchase invoice

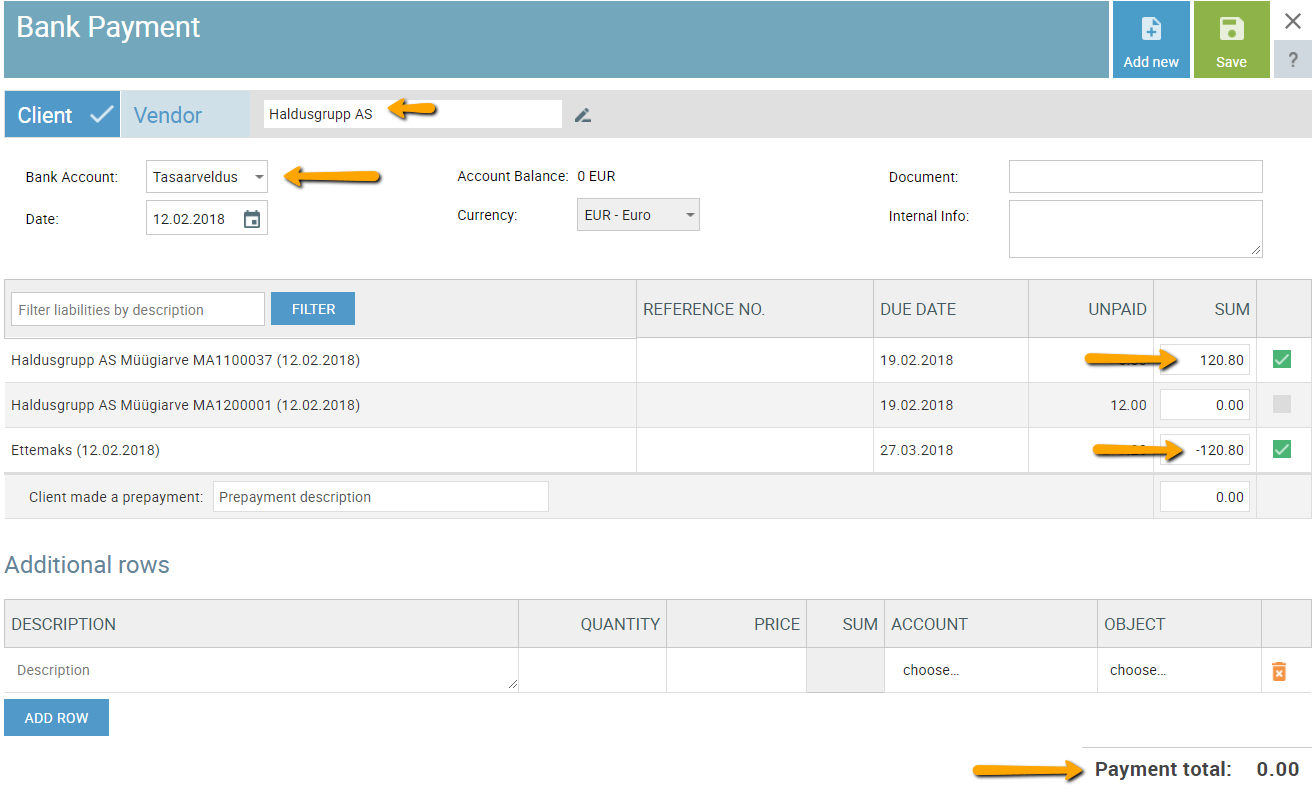

If your client has an outstanding prepayment which has not yet been settled you can allocate it to the desired invoice. To allocate the prepayment please add a new bank payment (‘Payment’ – ‘Bank Payments’ – ‘Add new’) and:

- Find the client and tick the invoice and prepayment row;

- Select the right bank account. This should be: Netting Account (Tasaarveldus);

- Check that the payment amounts to 0.00 and save the payment.

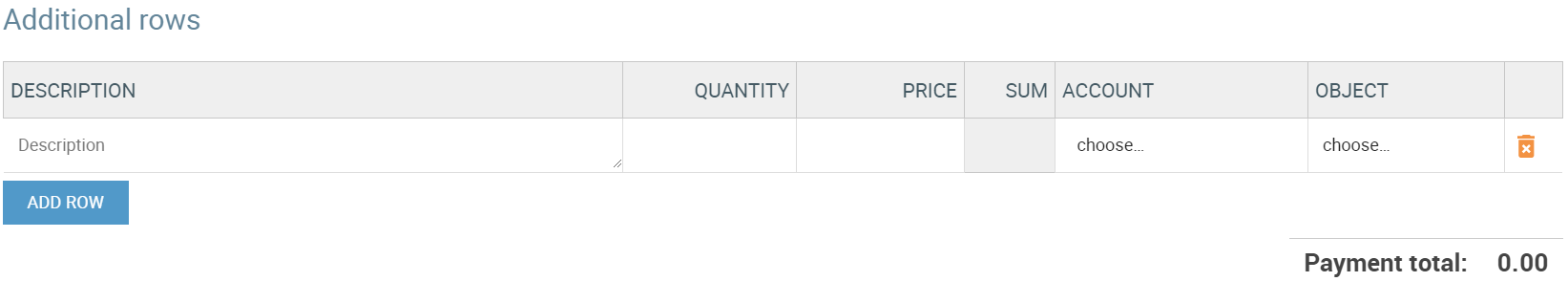

Additional rows

You can use bank payment additional rows to record different transactions:

- Bank fees

- Transactions between your own bank accounts

- Exchange of currency

Please note that a bank payment always has to involve the other party as well (client or vendor).

Bank Payments