Purchase Invoices

Easily add Purchase Invoices and attach related files to them.

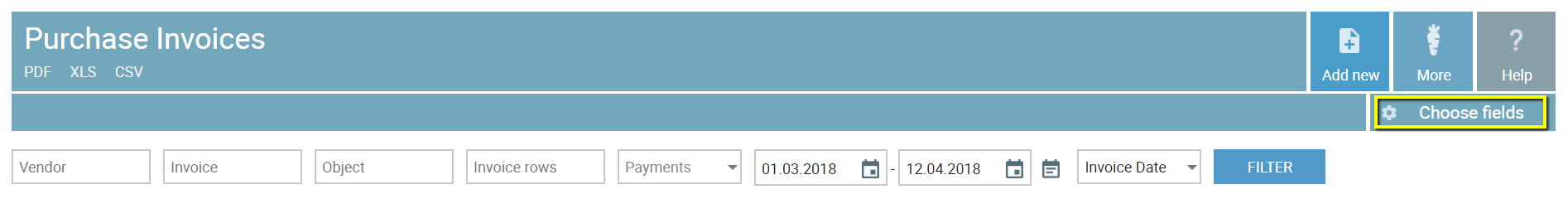

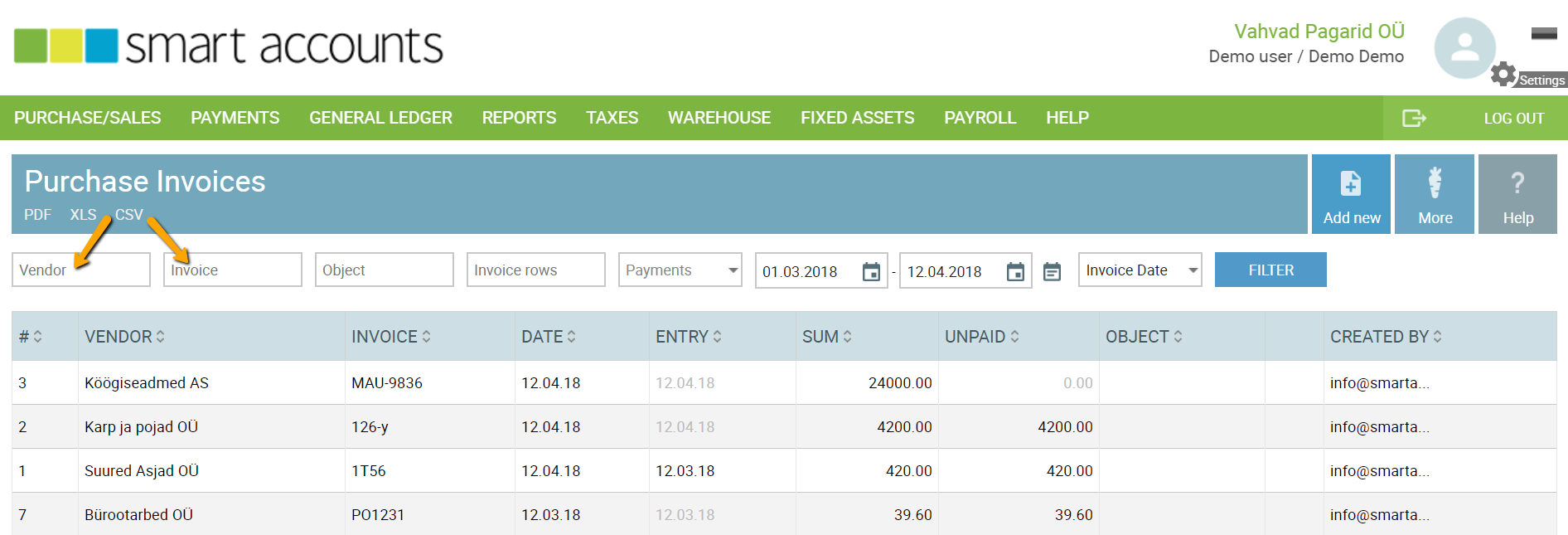

The list of Purchase Invoices

Under ‘Purchase/Sales‘ – ‘Purchase Invoices‘ you can see the list of all your purchase invoices. By default, you can see invoices from the beginning of the previous month until today. For the older invoices to be displayed in the list, just change the date range in the date filter.

To find a specific invoice, try to search by inserting the vendor name or purchase invoice number.

Under the menu item ‘More‘, you can access an option:

- Choose fields – choose which columns you want to see on purchase invoices screen

Add a new Purchase Invoice

You can add purchase invoices by navigating to ‘Purchase/Sales‘ – ‘Purchase Invoices‘ – ‘Add new‘.

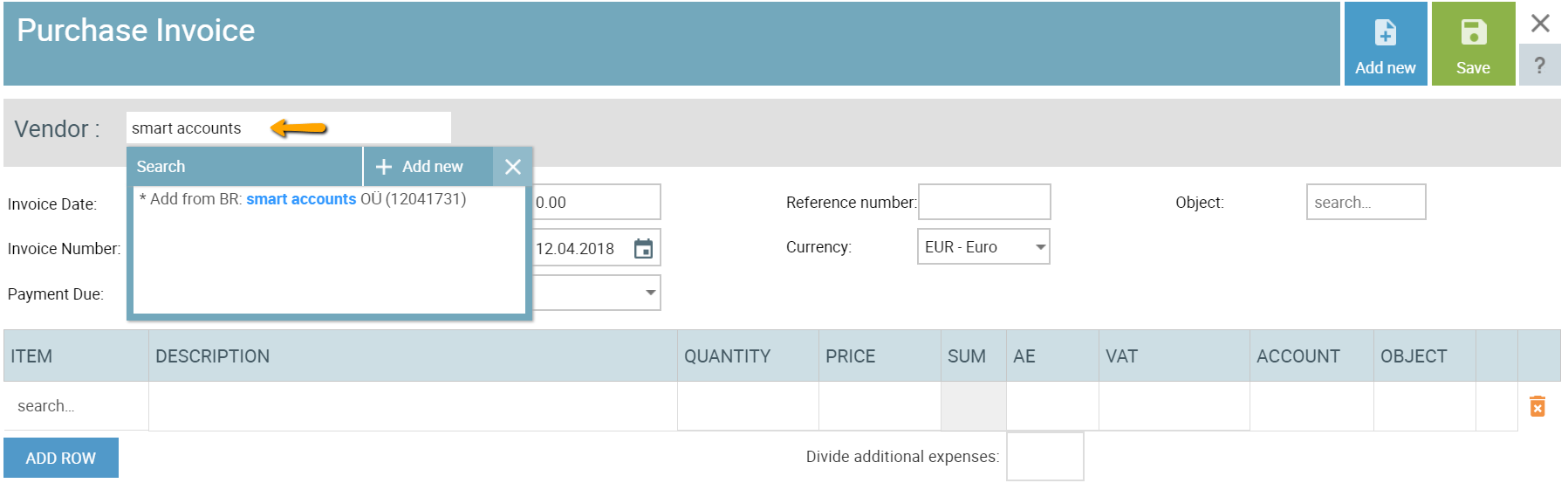

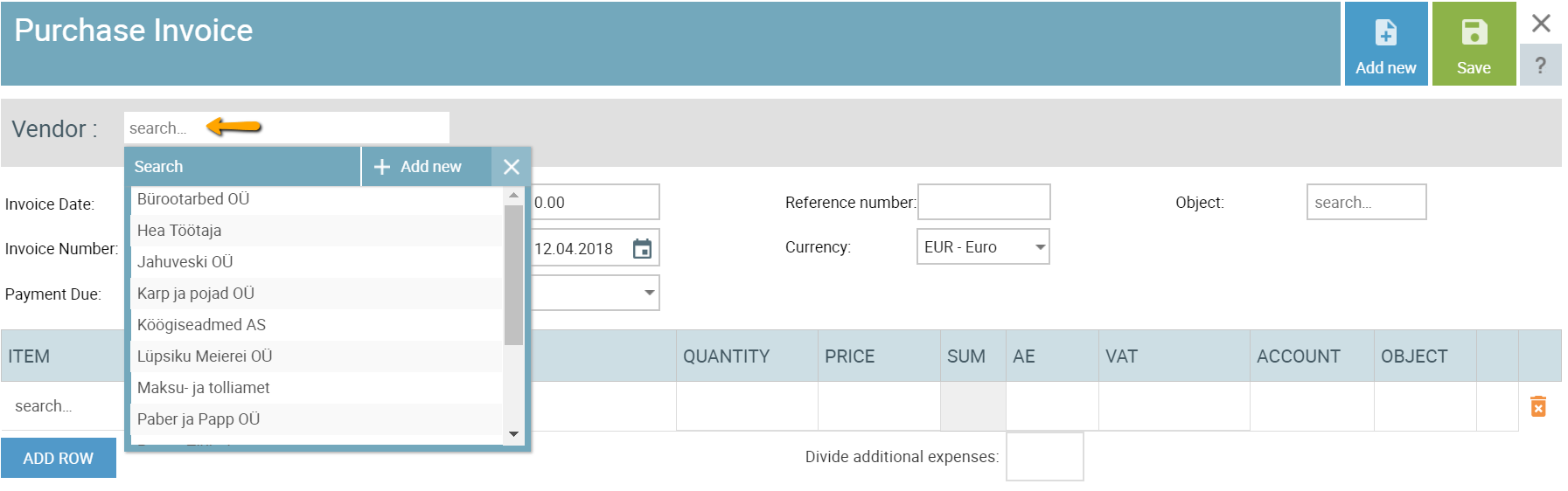

At first, please select the vendor who has sent you the invoice. You can select the vendor by inserting the name or part of it into the ‘Search‘ box.

If you want to add a new vendor to SmartAccounts, please click ‘+ Add new‘ and enter the details of the vendor.

In case the vendor is an Estonian company, you can easily query data directly from Estonian Business Registry on the purchase invoice screen. Just enter three letters of the name into the ‘Search‘ box and you’ll see results from the business registry and also vendors you’ve already added to your system. The new vendor will be saved after saving the invoice.

It’s worth noting that you should add the vendor from the business registry only once so when you save your first purchase invoice of that vendor you always choose the same vendor from your own vendors not the business registry entries.

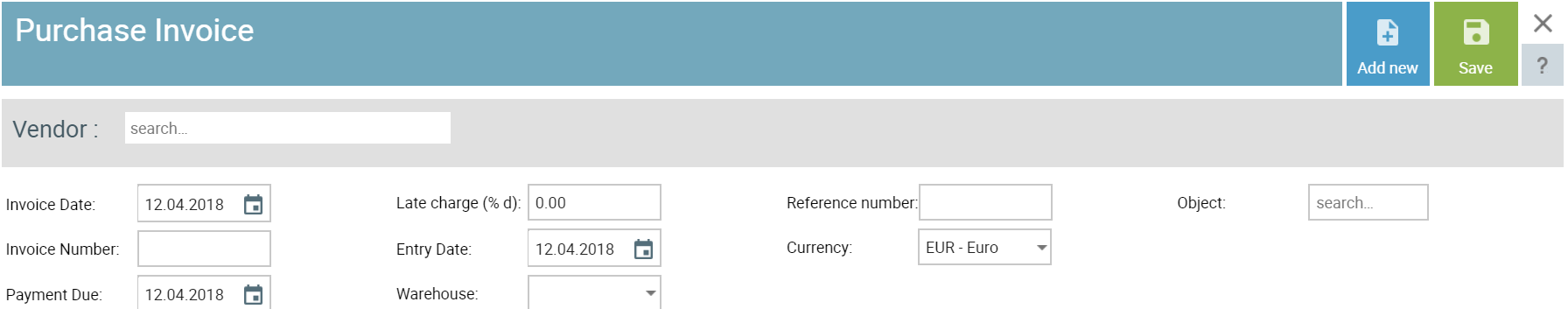

Now enter the remaining details:

Invoice Date. The date of the purchase invoice.

Invoice number. The number on the purchase invoice.

Payment Due. Due date of the purchase invoice.

Late charge (% d). Purchase inovice läte charge rate.

Entry Date. The date of general ledger entry. Typically the same date as the invoice date.

Warehouse. Company warehouse (choose if you use SmartAccounts stock accounting system)

Reference number. Purchase invoice reference number.

Currency. Purchase invoice currency.

Rate. Purchase invoice currency rate. Displayed if the purchase invoice is entered in the currency other than euro.

Object. Purchase invoice object (optional).

Purchase invoice rows

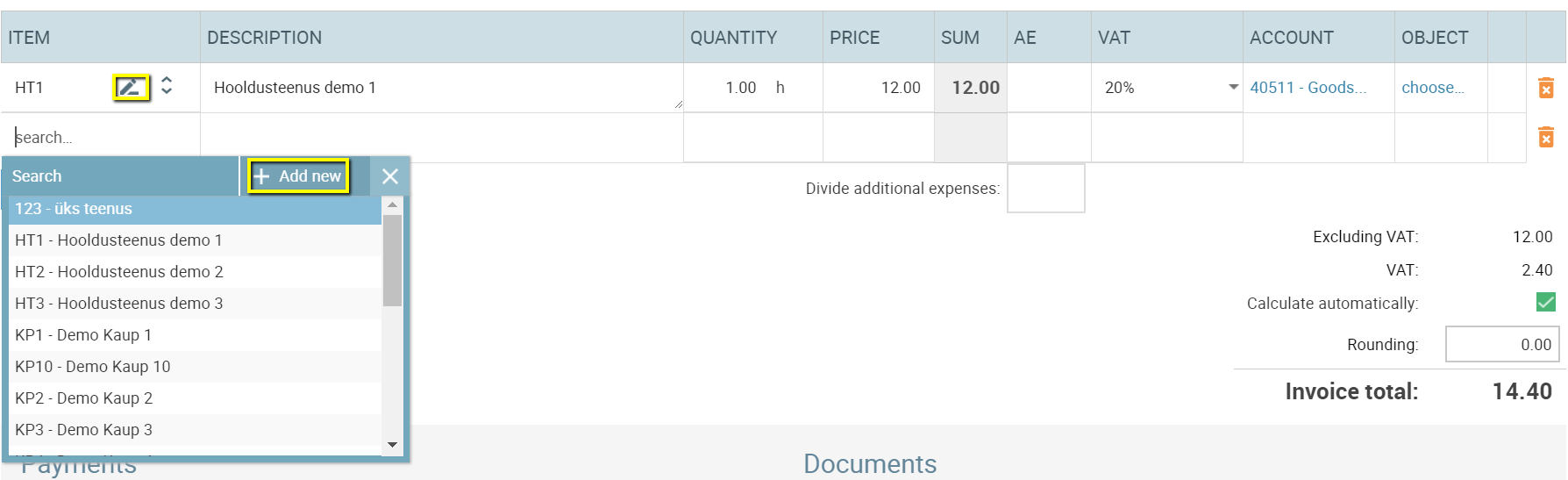

An invoice consists of invoice rows, and every row must have an item associated with it. New empty rows are added automatically. You can delete the row by clicking ‘Delete’ button at the end of the row.

Every invoice has to consist of at least one invoice row and item (service/product/warehouse). The code, description, price, VAT rate and sales/purchase account depend on the chosen item. All of them (except item’s code) can be adjusted on the invoice row.

The item data can be changed by clicking ‘Edit‘ icon, and the new item can be added by clicking ‘Add new’.

These symbols are actually used in the same way all across the software: the pen icon is for changing the selected object and the ‘Add new’ button is for adding a new object (in this case it’s an item).

Description box allows for 1000 characters maximum.

Account. The account is defined on the basis of the item card settings and normally doesn’t need to be changed.

Object. Invoice row object (optional).

VAT rates

General value-added tax rate in Estonia is 20%

You can choose between several VAT rates depending on the content of the transaction. Available VAT rates are:

| 0% | export of goods, the intra-community supply of goods etc |

| 20% | general VAT rate in Estonia |

| 20% (Reverse Chg.) | intra-community acquisitions of good and services, the national reverse charge on metal products, acquisition of other goods and services subject to VAT |

| 20% (car 100%) | cars and car-related expenditures (the right to deduct 100% of input VAT) |

| 20% (car 50%) | cars and car-related expenditures (the right to deduct 50% of input VAT) |

| 9% | VAT rate for books, periodic publications, medicinal products and accommodation services in Estonia |

| 9% (Reverse Chg.) | intra-community acquisitions of good and services (books, periodic publications etc.) |

| Capital Assets 20% | acquisitions of fixed assets |

| Not on VAT decl. | for transactions that are not subject to Estonian Value-Added Tax Law |

| Free | supply exempt from tax (universal postal services, insurance services etc) |

Additional expenses (warehouse items)

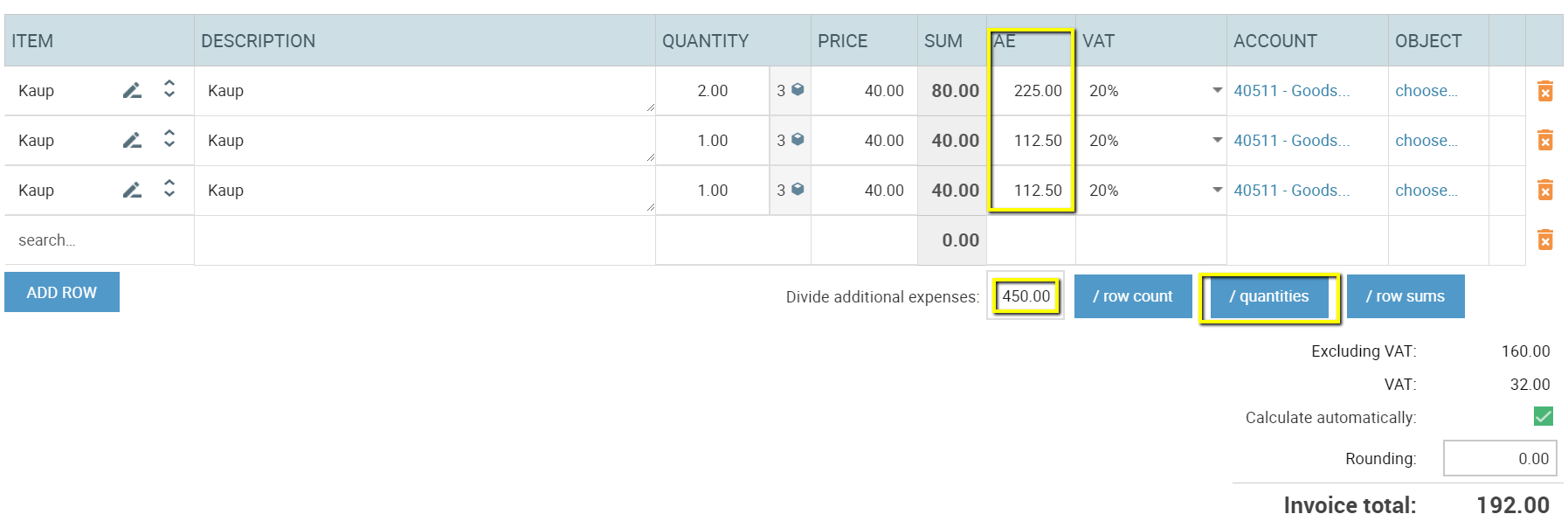

If you are using SmartAccounts warehouse system you can add additional expenses to the purchase price of the warehouse items on the purchase invoice screen as well. These expenses might be related to transportation, packing etc.

It is possible to divide additional expenses of inventory items by:

- row count

- quantities

- row sums

To include additional expenses in the cost of inventories please use the box ‘Divide additional expenses’ below the invoice rows. You can divide your expenses manually or automatically by inserting the total amount of expenses and choosing whether you wish to allocate expenses by row count, by quantities or by sums.

It is important to note that all the additional expenses have to be related to the default warehouse extra expense account. You can check default accounts by navigating to ‘Settings’ – ‘Default Accounts‘ – ‘Purchase‘ – ‘Warehouse extra expense account‘.

For Income Statement Scheme 1 the default account is 40513 – Transportation

For Income Statement Scheme 2 the default account is 4306 – Transportation-Marketing

Section ‘Documents’

Documents

Here you can attach files that are related to the purchase invoice.

Internal info

Any internal information concerning the purchase invoice can be entered into box ‘Internal Info‘.

More about the purchase invoice screen

Payments

This section is used to mark the invoice as paid directly from the purchase invoices screen. This can also be done in the payments section of the software but we’ll cover that in another tutorial.

‘With invoice’

This payment method should be used when full, or partial payment takes place at the time of invoicing. By default, we have two payment methods (‘Cash’ and ‘Reporting person’– both of them related to currency EUR).

You can create payment methods as you wish under ‘Settings‘ – ‘Payment Methods‘ – ‘Add new‘.

‘Bank payments’

The second option and more common one is to mark invoices as paid through bank payments (option ‘Add Cash/Bank Payment‘).

‘Add Cash/Bank Payment‘ on the invoice screen

Under ‘Add Cash/Bank Payment’ you can add a date when you paid for the invoice and the amount you paid from your bank account.

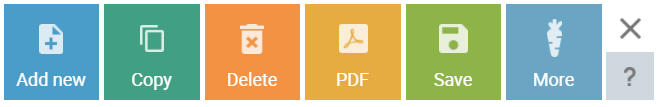

Purchase Invoice menu bar

Add new – Add new invoice

Copy – Copy the data of the current invoice (client, invoice rows)

Delete – Delete the invoice

PDF – Generate purchase invoice PDF (not the original purchase invoice pdf)

Save – Save the invoice

More – under ‘More’ you can find options set out below:

- Open Entry – See the general ledger entry of the purchase invoice

Keyboard Shortcuts

Ctrl+S Save, Create report

Esc Close

Ctrl+M Open invoice (PDF)

Dialogue Boxes

Esc Close the invoice add or edit screen

Enter Confirm

Purchase Invoices